Monthly Report

JANUARY 2024

New Year Resolutions

The rally in global equity markets, from the mid-October low, partially reversed in December as central banks made it clear that although the pace of interest rate hikes is slowing, rates will nonetheless probably have to stay at peak levels for quite some time in order to get inflation all the way back down to the 2% target. Bond yields accordingly moved back up towards recent highs. Initial relief at the prospect of relaxation of the “zero-covid” restrictions in China was tempered by realisation that the escalating virus can now itself disrupt the economy for a time until herd immunity is achieved. Emerging markets equities nonetheless continued their recent outperformance on news of a stimulus package to boost growth in China. The Bank of Japan’s decision to finally tweak its super-easy monetary policy sparked a 6.7% drop in the Nikkei and further Yen strength.

The MSCI World index of global equities was down 4.1% in December. The relative underperformance of the US market reflected a greater weighting in the “Growth” stocks that again led the decline. Underperformance of “Growth” V “Value” was a key theme in 2022 with cumulative underperformance since the December 2021 peak now at 28%. Equity markets in general were down about 20% in 2022. Energy was the stand-out sector (+59%) while defensive sectors like Consumer Staples and Healthcare showed only marginal losses. The worst performing sectors were Communication Services (-40%), Consumer Discretionary (-38%) and I.T. (-29%). Bond price indices were down about 16% in general. The US ten-year government bond yield started the year at 1.5% and finished at 3.9%, still below the October high of 4.2%. The German yield started at minus 0.18% and finished at a new high of 2.6%.

Asset Market Outlook

The course of markets in 2023 and beyond will be significantly determined by resolution of three things: the extent of recessionary impact from the ongoing lagged effects of recent and still intended monetary tightening, the accumulating evidence as to whether inflation is on course to return to the 2% target and the strength of central bank resolve to impose whatever degree of recession is necessary to fully tame inflation.

Inflation can be expected to continue falling in response to lower commodity prices and unwinding virus-related bottlenecks, but wage negotiations and fiscal spending will be watched closely for signs that a residual inflation habit is becoming behaviourally ingrained.

The past forty years of structurally falling inflation and real interest rates was led by globalisation and technology advance. The question now is whether or not the structural environment is deteriorating with de-globalisation, carbon containment costs and reversal of the “peace dividend”.

The benign scenario of mild recession, structurally intact disinflation and dovishly pivoting central banks would be best for equities and also good for bonds with yields moving lower.

The deeper the recession the worse the outlook for equities as earnings get hit harder, and the better the performance of government bonds as yields move commensurately lower.

Ultimately, central banks would be more predisposed towards easing to protect the economy than making sure that inflation is fully tamed. This would provide the scope for recovery in equities, but any subsequent signs of a lingering structural inflation problem could cut short the recovery as bond yields move back up.

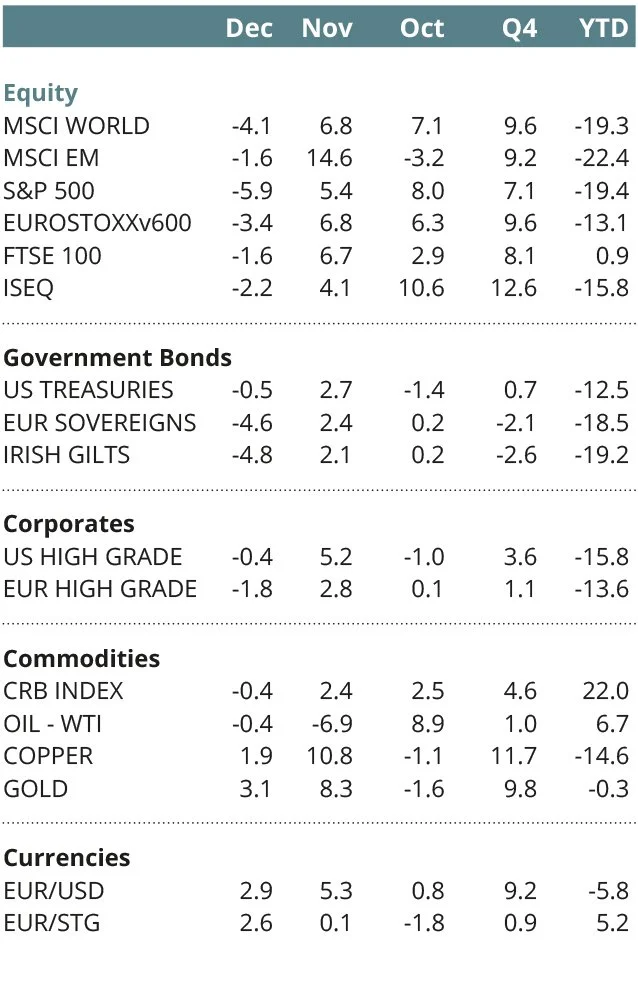

Global Financial Market Performance (%)

Equities

Equity markets finished 2022 in subdued mode and looking range-bound as we await resolution in 2023 in respect of the depth of potential recession, the progress of underlying core inflation and the related evolution of central bank interest rates. If history is our guide, the S&P 500 index of US equities will continue to dictate the direction and turning points for global equity markets in 2023. The US market looks to be priced for a mild/technical recession but not for a more significant one. On a cautionary note, the “FANGT” / “Growth” / NASDAQ stocks that led the bull market have also led the recent bear market and these are still testing or making new lows.

Bonds

The historically steep rise in bond yields in 2022 reflected the degree of inflation shock and related response in central bank interest rates. Bond yields look to have peaked for this cycle and the downside for yields in 2023 (upside in bond prices) is largely dependent on how much the economy weakens. If the structural evolution over recent decades towards disinflation and very low real interest rates is still intact, the risk of a lingering inflation problem could be low, implying that the recent peak in yields could be a major one-off high with major downside potential. If the structural environment is now becoming less benign for real rates and inflation, the potential for yields to revisit recent highs in the next cycle comes into the frame.

Currencies

2022 was dominated by US Dollar strength as the Fed led the way with its most aggressive hiking of interest rates in decades. 2023 looks like being characterised by some reversal of Dollar strength as other central banks play catch-up. The Euro has already been recovering since the ECB recently accelerated its tightening. More recently, the Yen has rebounded sharply from historic lows as the BoJ has finally begun to temper its super-easy monetary policy in light of rising inflation.

Commodities

The CRB index of oil and other commodities continued very strong in the first half of 2022, rising over 40% by early June, driven by the Ukraine sanctions and climate-related underinvestment in fossil fuel supply. This has clearly aggravated the inflation problem stemming from virus-related bottlenecks and massive monetary/fiscal stimulus. By mid-year however, worries about economic growth took over. The index lost half its year-to-date gains in June/July and has meandered sideways since then as demand worries vie with supply worries for dominance.